How to get your business into shape for 2021 and beyond

How to get your business into shape for 2021 and beyond

There are countless reasons why people start a business.

And even if it's been a while since you started your own, we are sure you'll remember what gave you that initial spark.

While COVID-19 continues to wreak havoc on many routines in our daily lives, it has been a catalyst for many business owners to revisit their plans.

Either to find ways on how to trade safely, even during the severe limitations imposed by local and national Governments.

Or to build on the original spark and to reinvent their business in the face of the changing market conditions.

At Business Finance Hub, we have been fortunate to help members achieve their goals, but never more so than in the last nine months!

That's why today we want to share how we've helped businesses to manage their finances and get into shape for the New Year.

Tips to get your business finances into shape

There is no doubt these are turbulent times.

Yet, we begin the year with cautious optimism, having provided free advice and guidance to thousands of GBCC Members in 2020.

And whether you need extra cash to retain jobs through COVID-19 or have opportunities to grow your business, we can assist with funding to support your plans, whether secured or unsecured, inside or outside of the Government schemes.

Irrespective of your circumstances, we have found that businesses that have the following documentation to hand fare better when they are seeking finance:

- What?

Latest set of financial results, with an overview of the Covid-impact on your business' trading patterns and revenue.

- Why?

Information about your planned expenditure, how much is funded by yourself and what percentage you are looking to raise.

- How?

Reasonable level of detail to show how you are planning to overcome challenges from the pandemic, or what measures you have already put in place to ensure you can operate safely.

What's next for business finance

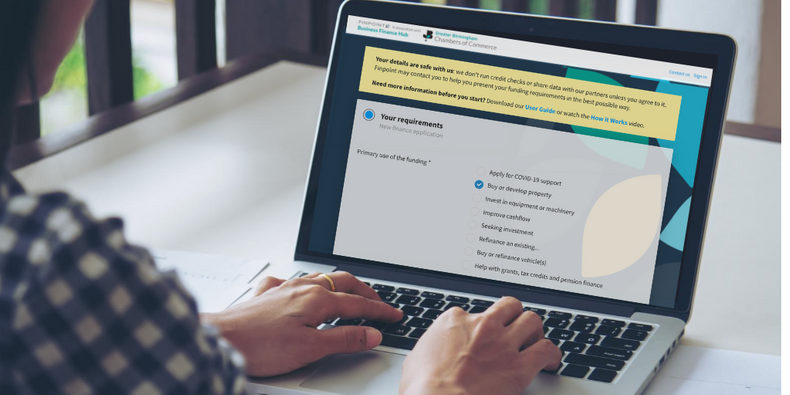

Our technology-driven process sits at the heart of our service.

It allows us to provide a 24/7 service, while making finding finance fast and efficient.

We understand that in uncertain times, it is important not to rush into taking out a loan.

But with sound advice from our impartial finance experts, we hope you feel empowered to get the right finance solution to set your business on a path of recovery and sustainable growth.

Below are some of the most popular business finance options that have worked well for other members:

Property finance, such as a commercial mortgage, can help you to buy your premises. It's rare for businesses to be able to buy a property outright, as this requires a large upfront investment.

Asset finance helps your business to access the equipment you need, like machinery, computers, office equipment, or vehicles, with an agreed monthly repayment over a period of time, typically one to three years.

Growth Finance is ideal if your business is looking to expand or enter new markets. Whether you're developing new products, buying new equipment, or embarking on new sales initiatives, a business loan can help you generate more revenue and profit.

Invoice finance is a way of borrowing money against unpaid invoices for a fee. You can receive up to 85% of the value of an invoice immediately, which can help to ease cash flow worries. The funder will collect the money owed from your invoices, and pay you the balance, less any fees.

………………………………….

News: The Coronavirus Business Interruption Loan Scheme (CBILS) has been extended to 31st March 2021 and is a key pillar of the government's support for businesses. It offers funding from £50,000 up to £5m and is suitable for established businesses that can demonstrate their ability to meet repayments for the loan level they apply for.

Apply Now and check CBILS eligibility in minutes.

Ready to explore your business finance options?

Whether you're looking to grow your business, make investments or support your cash flow, we are here to help.

As an GBCC member, you can use the service for free and save time with one simple online application, and let our experts handle the rest.