Six tips for managing your drawdown pension during a cost-of-living crisis

Inflation and the cost of living is on the minds of everyone these days, so it is understandable those who have reached retirement may be feeling additionally nervous. The inflation risk and the response by central banks has spooked markets so far this year and will have left many people who are either in drawdown or approaching retirement fretting about the impact on their retirement plans.

There are plenty of options for protecting the longevity of your pension pot even when prices are rising. While this will be more difficult in today's environment, proactive and prudent financial planning, including these tips, can allow people to stabilise their retirement income plan. Nobody can predict for sure how long your pension pot will last but utilising professional financial advice can also allow you to assess your pension income plans and take action if necessary.

Here are six tips for drawdown investors which could shape their standard of living and financial wellbeing during retirement in today's inflationary environment:

1. Take income from dividends and other assets

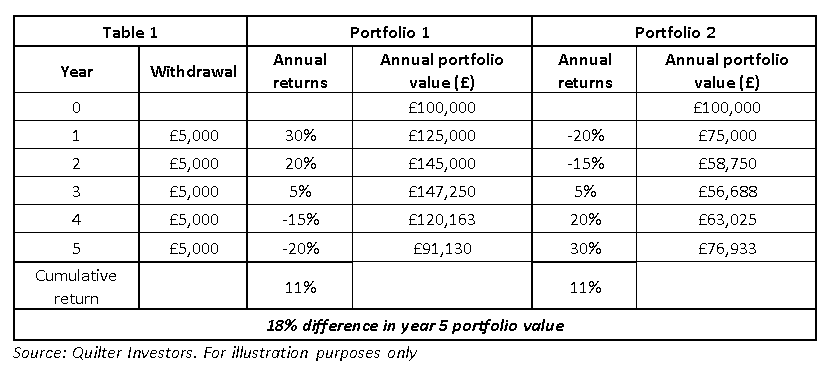

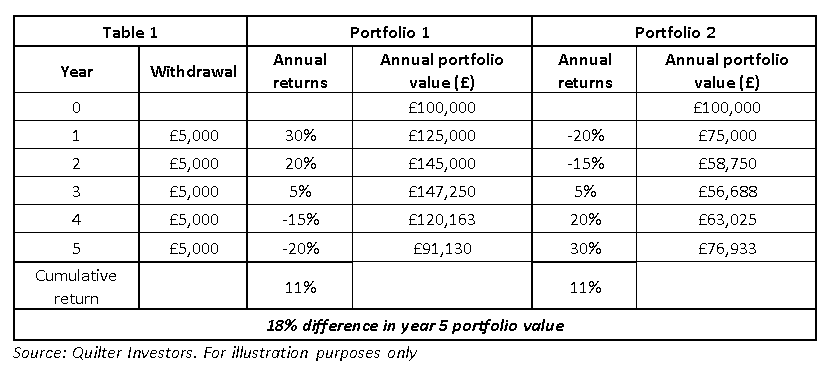

“When you are in drawdown the sequence of your investment returns is of vital importance. In the scenario shown below, which shows a retiree with a portfolio of £100,000, taking annual withdrawals of £5,000, their portfolio could be 18% worse off if they experienced losses in the first two years of retirement, compared to having these same losses in years four and five, and would be compounded by the current rate of inflation.

Returns of a £100,000 portfolio over five years

This is due to a process knowing as ‘pound-cost ravaging', where because of declining markets more investment units have to be sold to generate a desired income level, thus depleting the portfolio size during the early years of drawdown.

One way to avoid this and allow your pot to recover is to take your income from the dividends and bond payments that your underlying investments will provide. While dividends and bond yields can fluctuate, this approach avoids the requirement to lock-in a fall in the market by selling units in order to generate an income.

Another option is to utilise other assets in the medium term while market volatility and inflation subsides, particularly something like a cash Isa. This might provide a form of compromise which allows individuals to pause or reduce their pension income withdrawals, thereby avoiding the need to compound losses in their pension. If you have cash savings or other assets you can afford to live off and allow your investments to grow, then this might be the best option.”

2. Top-up your pension

Adding more to your pension pot could help to give you additional income when it comes to later life. Markets have suffered of late and as such some people will choose to invest now when asset prices are depressed in the hope that they can get a bargain. But of course, this does mean finding money to add to your retirement savings, which won't be possible for everyone without compromising on what they can spend today.

For those that go down this route it will be important to check your annual allowance. If you've already commenced flexi-access drawdown then you will be subject to a reduced ‘money purchase annual allowance' (MPAA), capping the amount you can pay into your pension with tax relief. There are ways to mitigate the MPAA before it is triggered such as withdrawing from small pots, where you can withdraw up to £10,000 on three occasions without activating the MPAA. You can also take your 25% tax free lump sum so long as the rest is placed is put into a flexi-access drawdown scheme with no income withdrawn. It can be a complicated area so speaking to a financial adviser could be beneficial for you.”

3. Delay retirement

If you are just beginning your retirement journey or you are not yet retired then it is worth thinking about prolonging your career. Many people choose to phase into retirement gradually, rather than seeing it as a cliff edge goodbye to work.

Shaving a few years off your retirement date removes the immediate term worries about cashing in your investments to generate income in order to tackle the cost of living. By delaying retirement, investors may be able to side-step both the inflation risk and the sequence of return risk to some extent.

4. Consider your investments

Traditionally, people are told to de-risk as they reach retirement age, moving from assets such as equities into traditional safe havens such as government bonds. However, many people in drawdown will now need their pot to last from anything up to 40 years. This is a huge time horizon and as such leaving equities too soon or in too great a proportion could have a devasting impact on your pension pot. Government bonds struggle in a time of rising interest rates and when inflation is high, whereas equities give you the best chance to beat inflation over the long-term and retain your purchasing power. For money that you don't plan on touching for a while, make sure you retain a decent exposure to the stock market.

Furthermore, consider other low-risk investments as an alternative to bonds. Areas such as infrastructure or alternative energy are good diversifiers and often their returns are linked to inflation. Having this good spread of assets will allow you dampen the effects of inflation on your portfolio, while retaining good growth potential for the future.

5. Stay invested

The important thing is not to panic. In the years since the financial crisis investors have enjoyed bumper returns in a low inflation world, and this has bolstered retirement pots. It means that despite the recent volatility in capital markets, drawdown investors approach this from a position of strength.

Doing nothing may seem counterintuitive but investors can be their own worst enemy in times of strife. There can be a temptation when markets fall to flee into cash but while a portfolio may be worth less at today's prices than it was just a few weeks ago, those losses aren't locked-in until the assets are sold. If you stay invested then there is an opportunity for them to recover. Furthermore, inflation erodes cash and given savings rates remain paltry, there is no chance for it to recover.

6. Consider reducing withdrawals

Those with smaller pots will need to think carefully about how best to protect the longevity of their retirement savings. For instance, someone with a £100,000 pot might have set-up withdrawals of around four per cent, or £4,000 per annum. However, they now face a tough decision as that £4,000 will no longer have the same purchasing power it did just a year or two ago. During these times it is critical to assess whether you need to take as much out as you usually do. Look at where spending can be cut back or if additional savings can be made and leave these invested.

However, if you are in the unfortunate position where you need to take more out to help make ends meet check how sustainable this will be. Remember you do not need to take out the same amount of income each year so you can allow your pot to recover during more sanguine times.

Pictured: Ian Browne, pensions expert at Quilter